Lancashire Holdings Ltd 2024 results

Lancashire Holdings Ltd reported its group results for 2024 to the LSE yesterday.

The full Press Release is available here as well as the slides on Lancashire's website.

Key extracts as follows:-

- Profit after tax of $321.3 million, (2023: $321.5 million)

- Gross premiums written + 11.3% to $2,149.6 million, (2023 $1,931.7 million)

- Undiscounted combined ratio of 89.1%, (2023 82.6%)

- Favourable prior year loss development of $121.1m (2023: $78.8m)

- Total investment return of 5.0%, including unrealised gains and losses.

- ROE of 23.4% (2023: 24.7%)

- Cautious 2025 forecast ROE: "With a similar level of catastrophe and large losses as 2024, in addition to the wildfire loss, we would anticipate delivering an RoE

in the mid-teens in 2025."

Other extracts from the Press Release, as follows:-

Claims

"Lancashire experienced net losses (undiscounted, including reinstatement premiums) from catastrophe, weather and large loss events totalling $214.1 million [2023: $106.1m). This included the impacts of hurricanes Milton, Helene, and Debby, storm Boris and the Calgary hailstorms. The MV Dali Baltimore bridge collision was the most significant large risk event."

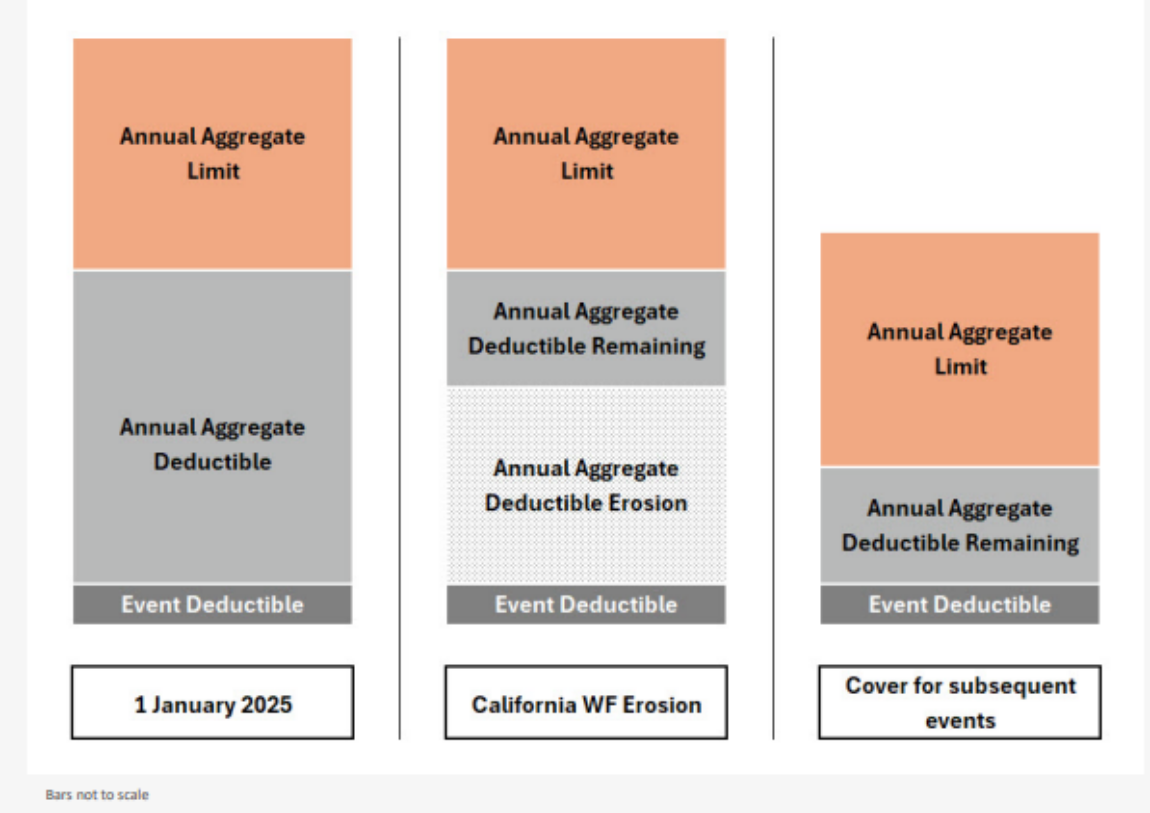

"Early in 2025, we have seen the terrible devastation wrought by the wildfires in California on those communities. As recently announced, for Lancashire, the impact is expected to be within the range $145 million to $165 million".

This erodes the Group's annual aggregate deductible as this screenshot from the slides shows:-

Renewal Price Index

Reinsurance: "largely flat" at 101%; gross premiums +13.5%. "New business within the property reinsurance and specialty reinsurance lines was the most significant driver of growth."

Insurance: RPI of 101%; gross premiums +9.1% "There were also increases within the casualty insurance and energy and marine insurance lines of business due to new business growth."

Conclusion

The Group has made the same level of profit as 2023 notwithstanding the impact of the disasters and other losses affecting the group of US$214.4m in 2024. The shares fell about 5% on the day of the results but were gradually climbing back up a day later.