Hiscox Ltd group 2024 year results

Hiscox Ltd has released its 2024 year preliminary results for the group.

The press release is available here on the Hiscox website and the following are our selected extracts for the areas which we think are of most interest to Members:-

- ICWP* increased 3.7% to US$4,766.9m, driven by accelerating growth momentum in Retail division and hard market growth in Re & ILS division;

- Record profit before tax, second consecutive year, of US$685.4m;

- Investment result of US$383.9m, (4.8%), continues to benefit from higher bond yields earn through;

- Reserve releases of US$145.5m;

- Undiscounted combined ratio of 89.2%;

- Final dividend of 29.9 cents per share, an increase of 19.6%.

Below are some extracts from the group's divisions that are informative for Members:

Hiscox London Market - uses the global licences, distribution network, and credit rating of Lloyd’s to insure clients throughout the world:

- ICWP down 2% to US$1,229.5m reflects pro-active cycle management within casualty and exit from space market

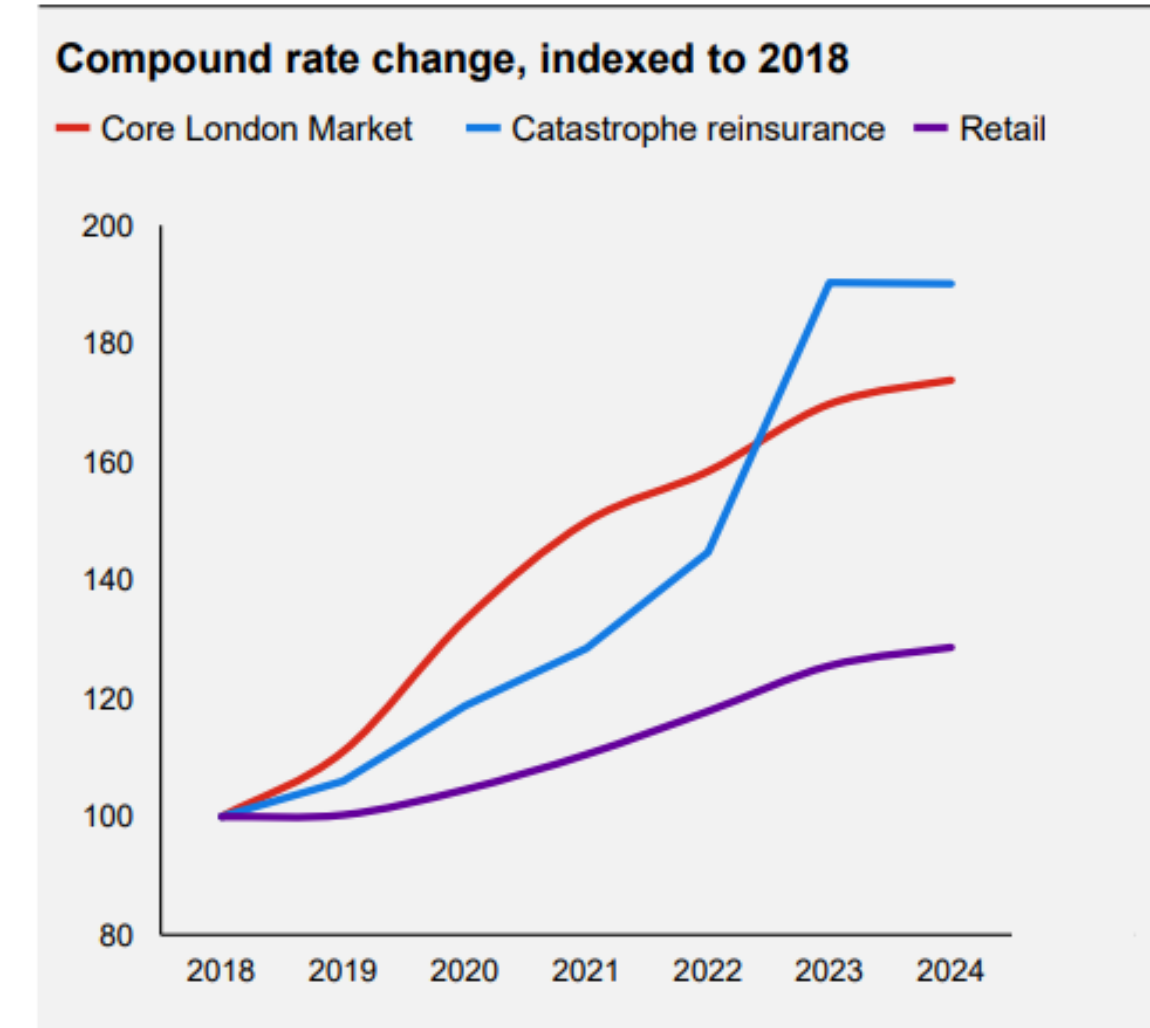

- Rate increases for the year were 2%, with cumulative rate increases of 74% since 2018

- Overall, despite increasing competition leading to some rate softening, market conditions remain attractive

- Growing where market attractive such as Terrorism +16%, Commercial +8%, Hull +8%

- In casualty, we continue to manage the cycle following rate reductions of 8% in cyber and 9% in D&O, while using improving rate in general liability to decrease line size and reduce exposures

- Fifth consecutive year of undiscounted combined ratio in the 80's

Hiscox Re & ILS - comprises the Group’s reinsurance businesses in London and Bermuda and insurance-linked securities (ILS) activity written through Hiscox ILS:

- Net ICWP of US$499.3m up 159% since 2020, as business has grown into the hard market

- Undiscounted combined ratio below 70% in an active year with industry weather-related losses of c.US$145bn

- "The market remained disciplined throughout 2024, with attachment points holding, terms and conditions stable, and rates broadly flat following cumulative rate increases of 90% since 2018. January 2025 renewals were more competitive as capital, typically in the form of retained earnings, pursued growth. This has had an impact on the market, with rates down 8% at the important 1 January renewals, although attachment points and terms and conditions have remained broadly stable. Market conditions, coming from the significant highs of 2023 and 2024, remain attractive and we have deployed additional capital into the opportunities that provide the best risk-adjusted returns for the portfolio."

Claims

"2024 was an active natural catastrophe year, with five hurricanes making landfall in the USA, flooding in Spain, Germany and central Europe, and a number of weather events in Canada. Natural catastrophe losses were within expectations, with a reduction in our initial loss estimate from Hurricane Milton offset by an increase in the amounts reserved for certain other 2024 loss events."

- MV Dali collision in Baltimore US$28m net loss reserve;

- LA wildfires of January 2025 US$170m net loss reserve based on an industry loss of US$40bn - "Our estimate, which will be booked in the first quarter of 2025, includes reinstatement premiums and does not make any allowance for subrogation."

Hiscox expects the wildfires to drive future impacts in the market such as extra reinstatement premiums and back up covers; and a market impact on rates, both loss affected and broader; and, available capital and risk appetite changes.

Reserves

"In 2024, net reserve releases were again broad-based, from multiple vintages and classes of business, aggregating to $145.5 million (2023: $122.8 million)"

Summary

All the figures above show a strong set of results, in an active loss year, reflecting the excellent trading conditions.

Lloyd’s will issue the complete schedule of third party syndicates’ 2022 results and updates to 2023 forecasts on the 20th March.

*Insurance Contract Written Premium - before expenses and commissions